Primer -- Asset Allocation

How we approach asset allocation

Asset allocation is an important part of the portfolio management process. While the premise is simple — to weight assets by risk and returns (a la Markowitz), implementation is challenging given the variance in capital market assumptions. Investors today choose from a wide range of asset allocation strategies — Black-Litterman implementations to Risk Parity to Equal weighted portfolios.

Our view around asset allocation is that investors should start with risk parity (or naive equal weight) and then seek strategic adjustments through our asset allocation framework.

Economic Backdrop

The value of a security is equal to the sum of future cash flows discounted to present value.

Bond-equity correlations are time-varying as both equity and fixed income securities are driven by (1) changes to the estimate of free cash flows, (2) changes in the discount rate, and (3) the time period of the analysis. Separating the idiosyncratic drivers of returns from systematic ones is a necessary step in asset allocation.

Systematic factors tend to increase correlation while idiosyncratic factors tend to decrease it. The most important systematic factor, in our view, is duration risk. Duration, the time it takes for a security to pay back its value, is a good proxy for investor speculation of monetary policy and economic growth, both of which are primary drivers that influence the discount rate. Simplistically, duration impacts equities through the multiple, causing P/Es (and other valuation metrics) to expand or contract. Whether duration is attractive, neutral, or not depends on the investors view of the economy and monetary policy. A view on duration has implications for both bond and equity exposure.

Idiosyncratic risks for bonds and equities revolve around two primary factors: credit and cyclicality. Credit refers to the types of covenant and cash flow risk an individual company has. Cyclicality refers to how sensitive a company’s revenue and margins are to changes in the economy. After setting a view on duration, investors then need to think about what type of credit and cyclicality is attractive (or not). This informs the sector views on equities and fixed income allocation. Hence, while bond-equity correlations are time varying, sub-factors contain collinearities which need to be stripped out when evaluating an asset allocation strategy.

To recap: bonds and equities share some similar drivers of returns, mainly the impact from duration risk. We recommend investors develop a view on duration separately from their views on credit and cyclicality. Creating this distinction is part of our asset allocation framework.

1. Risks & Returns

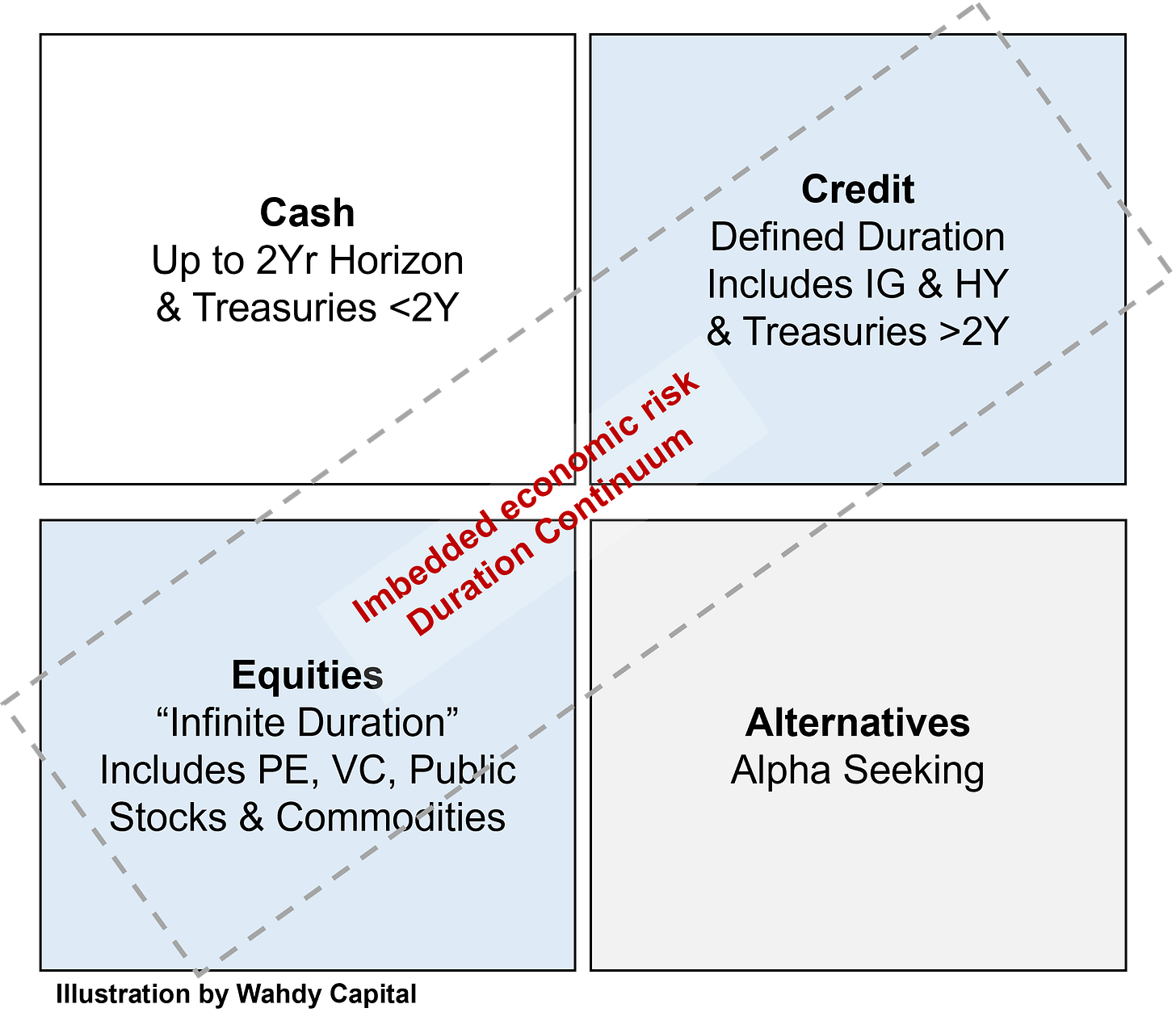

We like to organize asset classes into three primary buckets: cash, economic risk, and alternatives. We think investors should build portfolios that start with equal-weighting risk across these buckets.

Cash — the yield on cash and short-term treasuries, which is primarily a function of central bank policy

Economic risk — which includes the returns from equities, commodities, and credit where returns are driven by the business and interest rate cycle

Alternatives — returns generated from non-cash and non-economic risks such as relative value, event driven, and volatility

Within each bucket, there are sub-asset classes, strategies, and securities that can be tailored to enhance the risk and return profile.

We describe our overall view as the asset quadrant.

2. Asset Allocation

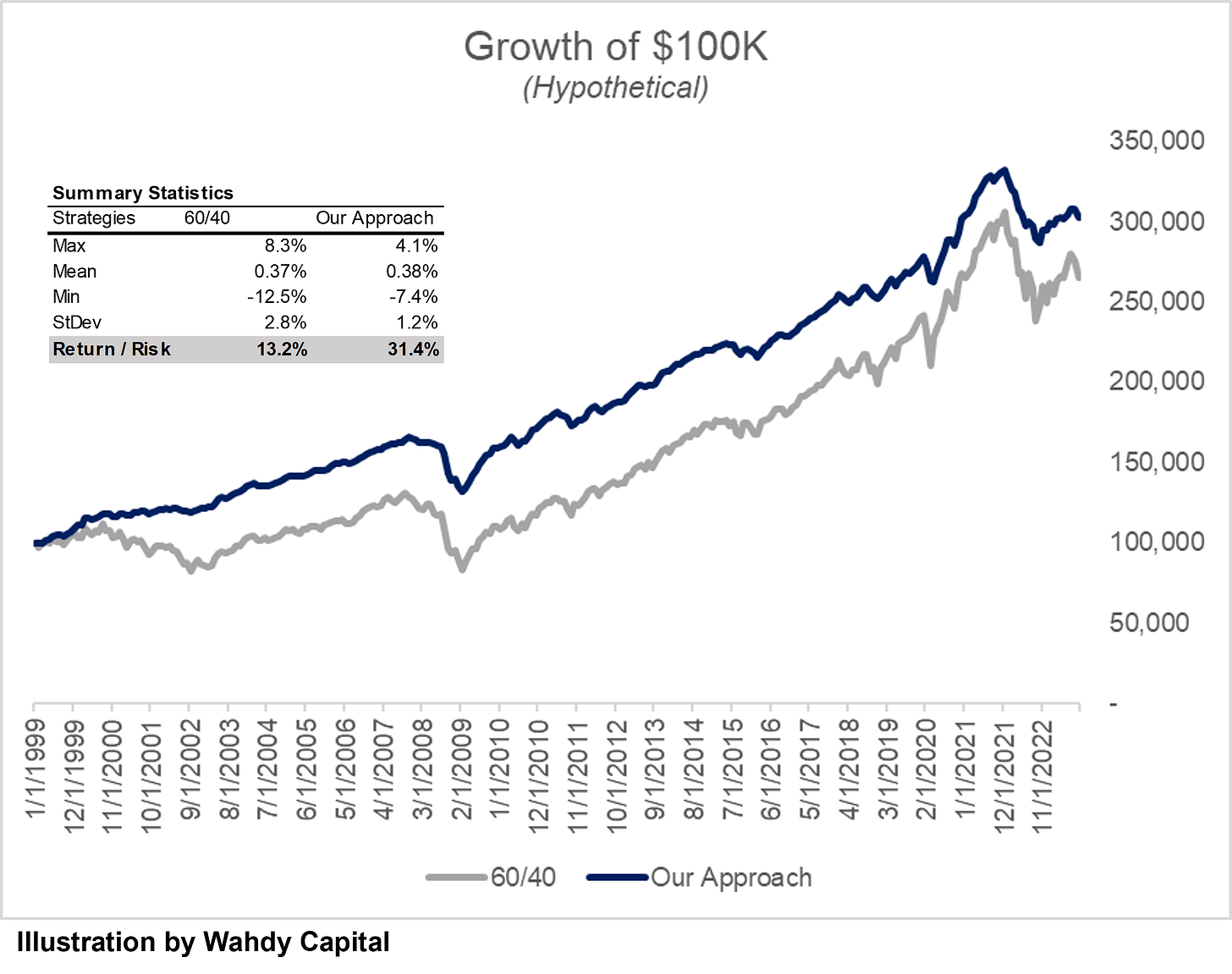

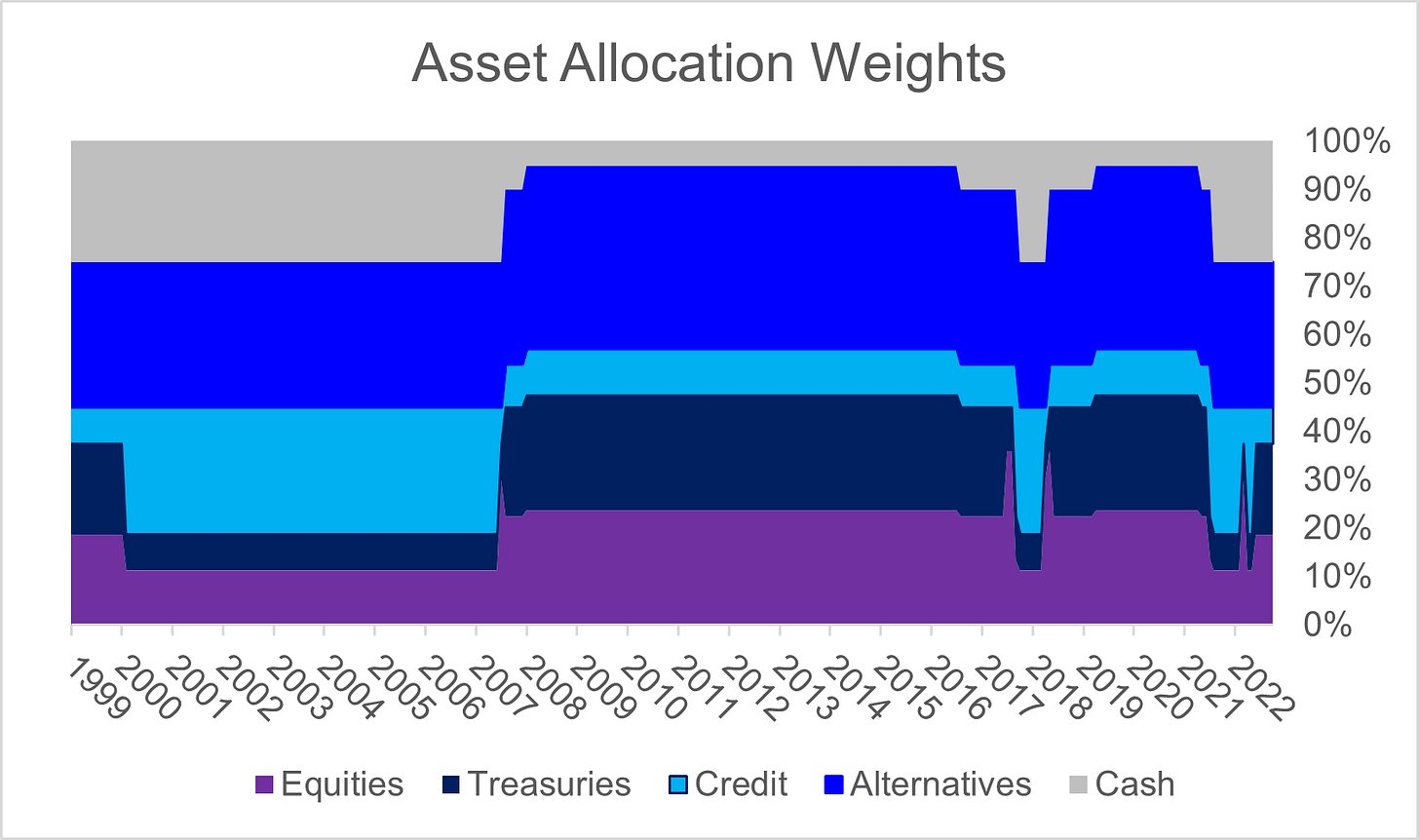

Our approach to asset allocation is rooted in risk parity portfolio construction. The premise is that forecasting future returns is hard; understanding the range of historical risk is much easier.

What makes our asset allocation advice different from a traditional risk parity portfolio is that we modify it based upon changes to duration and cash yields. Bond yield spreads dictates the mix of treasuries and credit, while cash yields dictate the allocation to cash (and short-term securities).

A hypothetical implementation of our asset allocation strategy outperforms a 60/40 portfolio.

3. Active Management

We believe in active management. Indexes play a key role in a portfolio, primarily for exposure, access, and comparison. However, we think good active management and robust security selection can reduce risk and improve returns in ways that are not correlated to general economic or market conditions.

In other words, once the asset allocation is determined, we think investors should prioritize on maximizing returns at the sub-asset and security level.

How do investors benefit from this approach?

It simplifies asset allocation by focusing on the drivers of systematic and idiosyncratic returns.

It helps investors by reducing their portfolio covariance and collinearities (“double dipping risk”).

It limits drawdowns by increasing the importance of cash in the portfolio.

How does this fit into Wahdy Capital’s investment strategy?

In addition to running our long/short strategy, we work with investors to build and manage custom portfolios, where asset allocation plays a big role as part of the investor mandate and benchmark for the portfolio.