Macro Notes - Our View Into 2024

Fed pivot means we are in a soft landing, but macroeconomic volatility will muddle the picture.

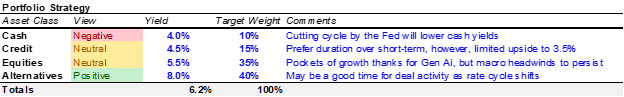

Summary Views

We are currently experiencing the “soft landing” – whether this persists through the year depends on the pace of rate cuts, disinflation, and if those can happen without crossing into a contraction.

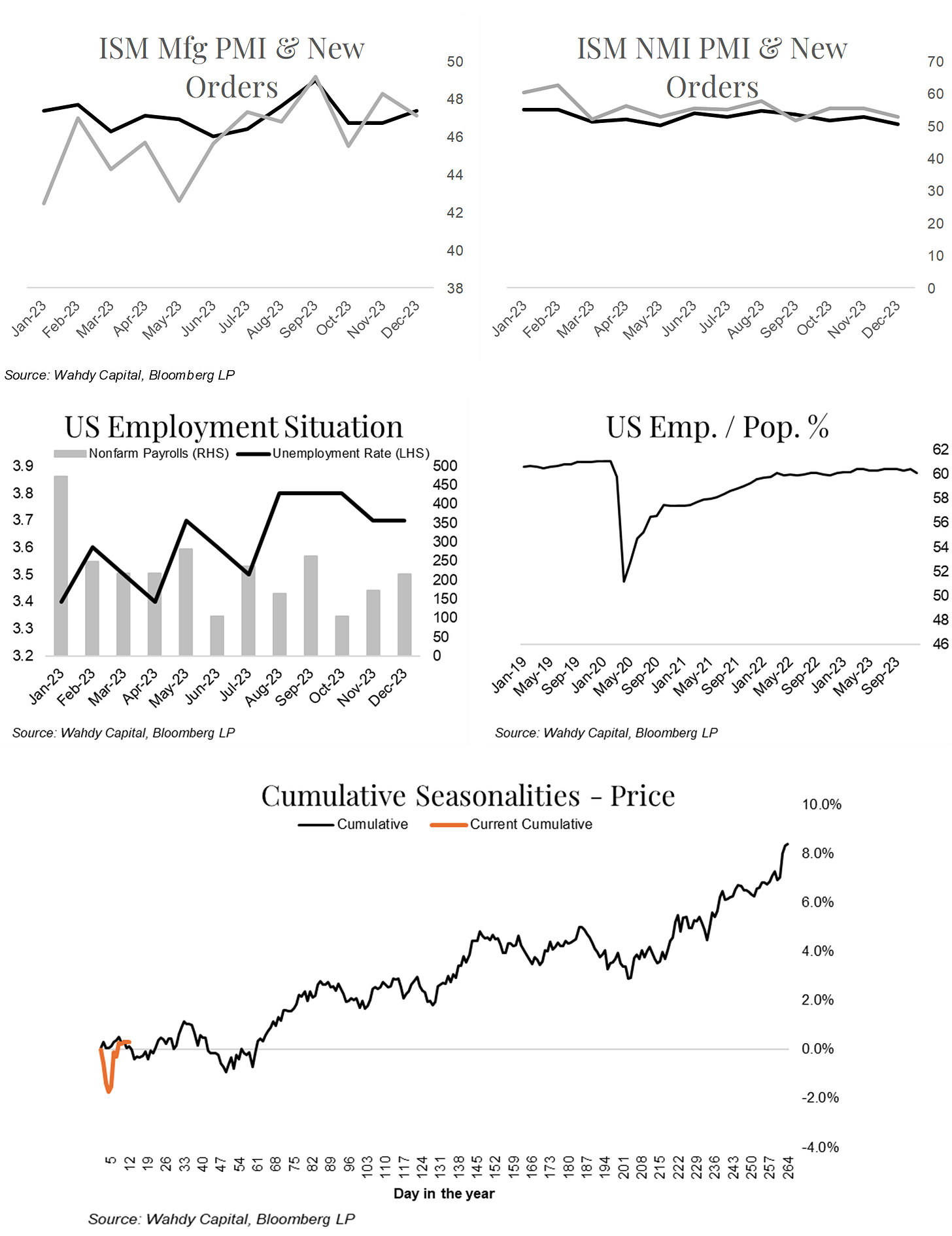

Positives for US growth in 2024 include an easier stance in monetary policy, low unemployment, and rising real wages. Negatives include weak new order growth, negative credit impulse, and structural headwinds in the labor market. On balance, we’re neutral on the economy but optimistic of our equity coverage.

Rates should move lower through the year making cash less attractive as the Fed positions to cut interest rates, tapers its QT strategy, and Treasury refunding needs marginally decrease.

Stocks should rise in 1H of 2024, and we expect earnings estimates to revise higher through the period as real wages offset the marginal uptick in the unemployment rate.

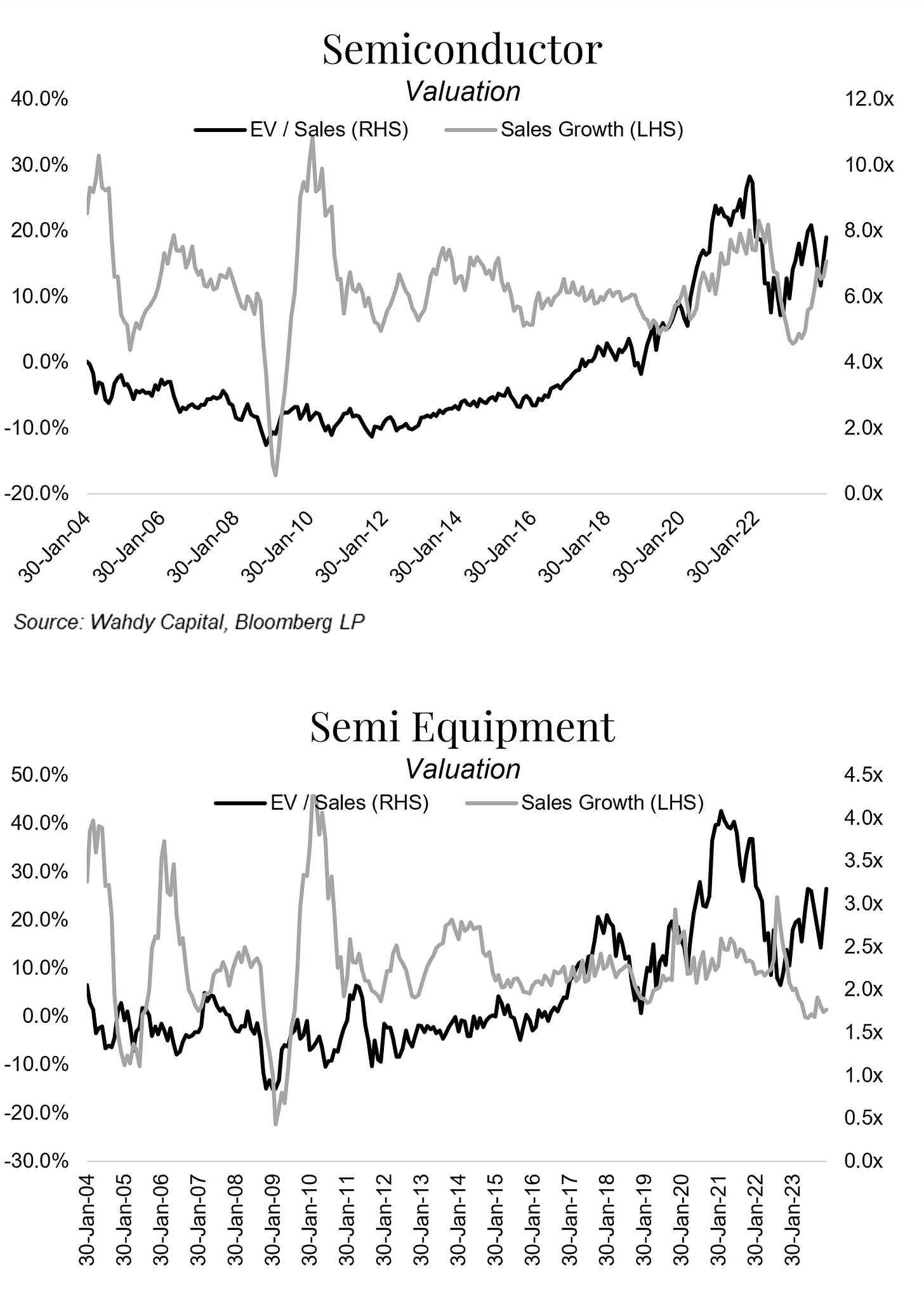

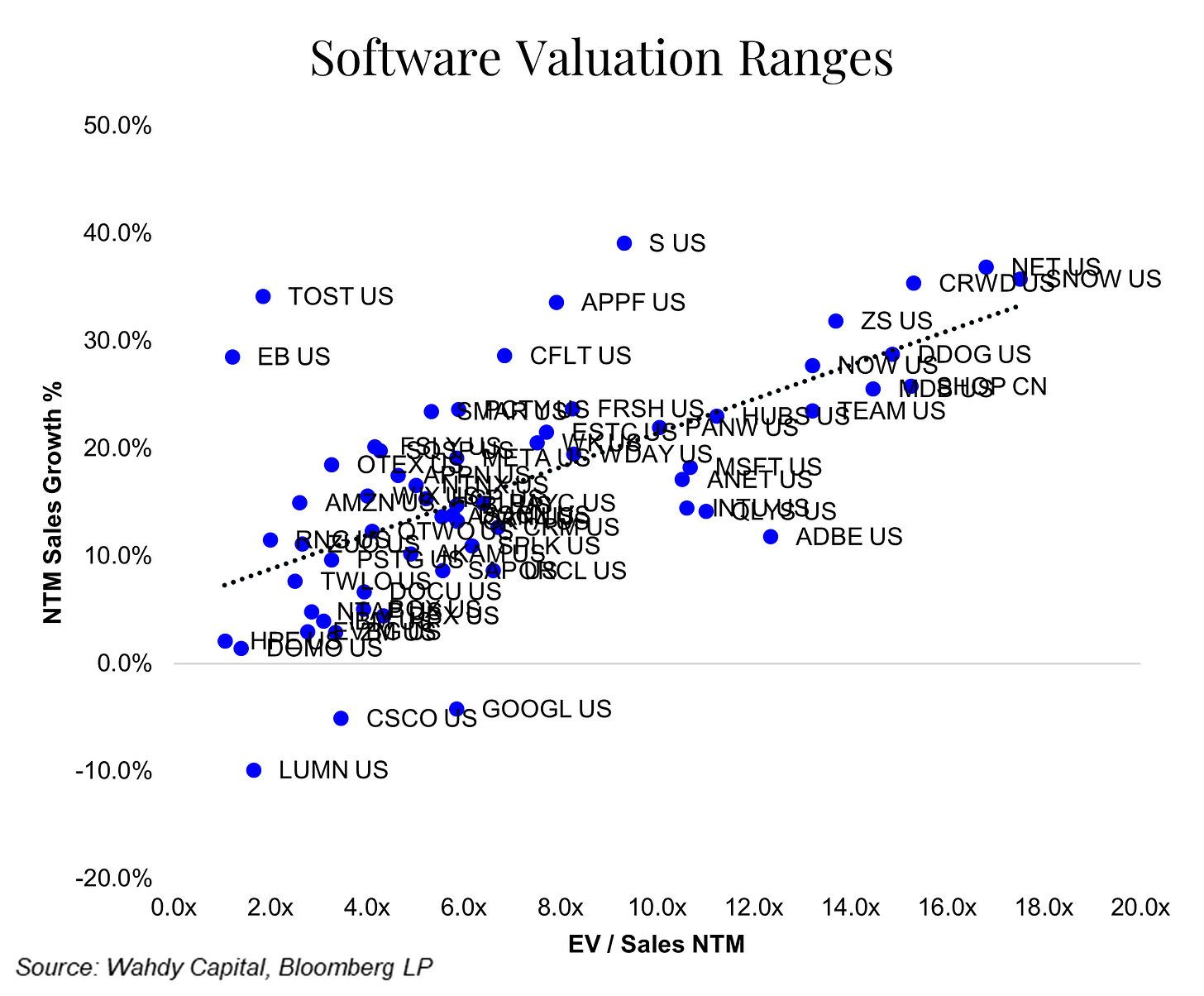

Within our coverage group, we are very optimistic about semiconductors and see pockets of growth in software. Semiconductors are moving into an expansionary regime driven primarily by new workloads creating an upgrade / retooling cycle among data centers. In software, an improving cloud and cyber outlook will lift some boats while slower sale cycles and weakness in SMB will impact certain verticals harder than others.

Market Outlook

Macro volatility to continue in 2024 as “early cycle” monetary policy intersects with structural headwinds in labor, production, and generative AI.

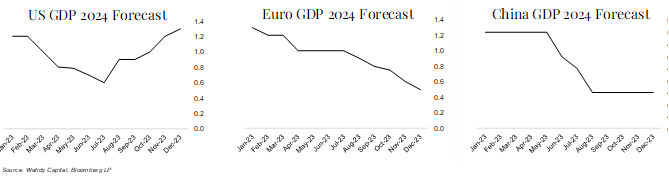

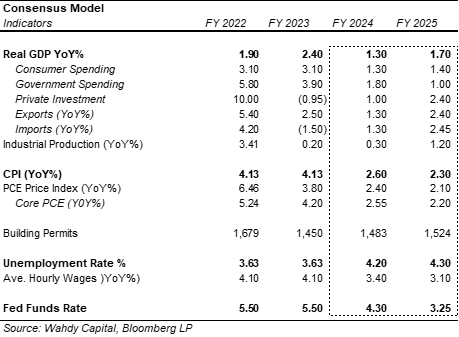

In the United States, we expect GDP growth to remain positive, though weak, through FY 2024. Our view is driven by (a) labor markets where the post-Covid shock jobs rebound is hitting against structural headwinds which will keep labor force participation rate below pre-Covid levels, (b) easier financial conditions to mute the impact of a contracted credit impulse, (c) continued weakness in new order growth to temper business optimism and capital expenditures. In short, no “green light” for the economy, but hard data should stay positive through 1H of 2024.

On the inflation front, we expect consumer prices to continue their descent, led by both a sustained decline in housing inflation (market-based rents are much lower than OER-implied) and healthcare costs.

We expect Monetary Policy to remain active, with interest rates falling through 2024 as the Fed proceeds with 100-150bp of cuts. In addition, the Fed is likely to communicate a tapering of its QT strategy during the January FOMC meeting, though it is widely expected to provide guidance in the meeting minutes rather than the presser itself.

Another theme to watch in 2024 is the disruptive impact of generative ai on a mix of industries and business models.

We were wrong!

We called a recession by the end of 2023 after the Banking Crisis in March of 2023. Though the Federal Reserve and Treasury supported credit markets and banks with BTFP, we viewed the deterioration in credit conditions as a significant driver of weakness by Q4. This has not panned out and BTFP is largely a success (in addition to the Feds RRP facility). Could there be a recession in 2024? Yes, but we do not think the data supports that view right now and the Fed has been largely successful in gliding the economy towards a soft landing.

Consensus estimates point to growth in 2024 with a modest reacceleration in 2025. While we do think that labor market softness may slow consumer spending and that high inventory-to-sales ratios will limit restocking in 1H 2024. We think caution is prudent as macro volatility will offer noisy signals despite an easing Federal Reserve.

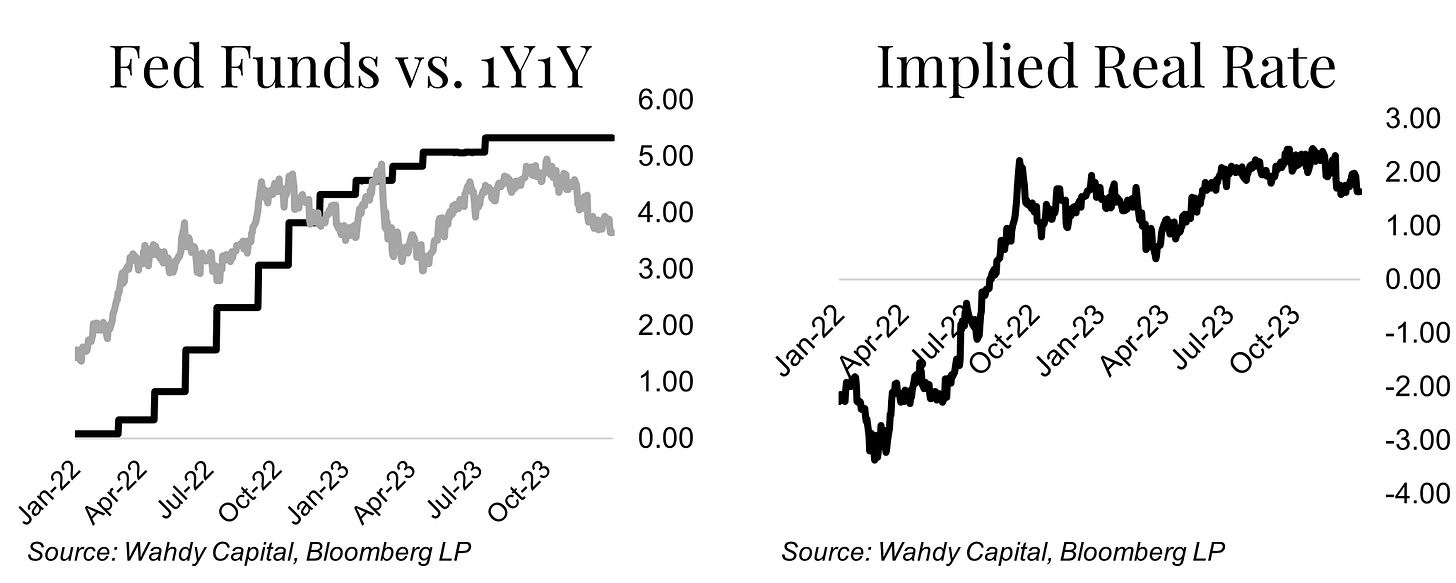

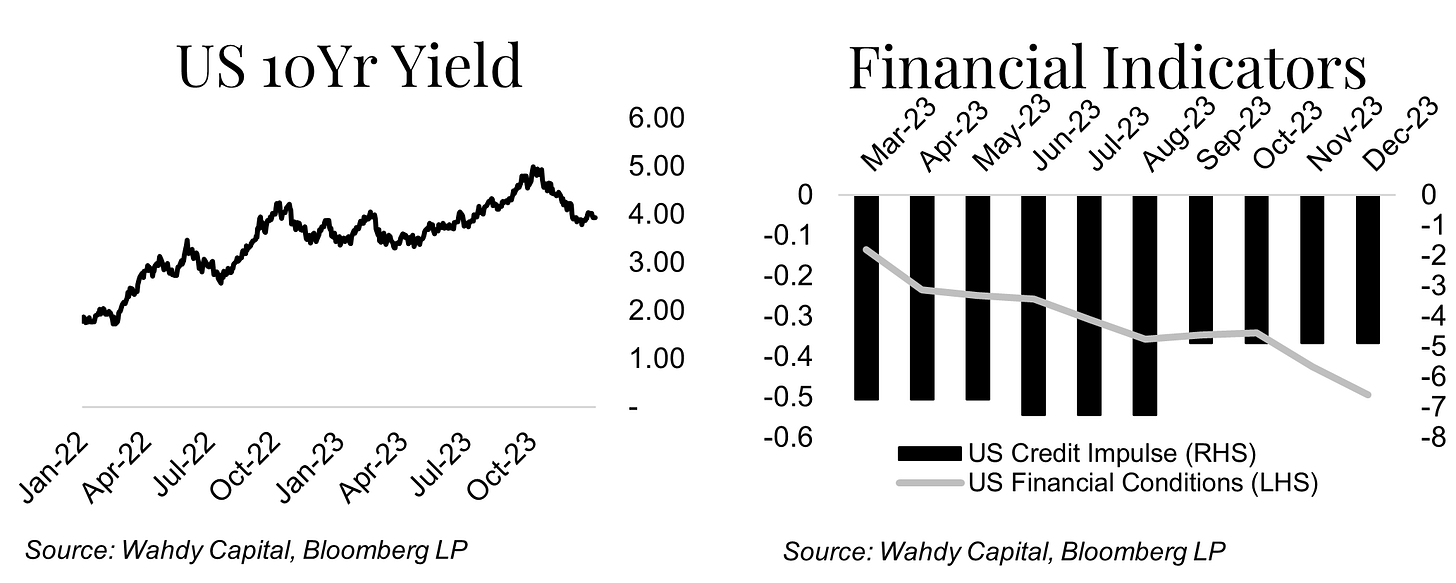

Treasury markets are pricing in 5+ cuts through 2024 as the Fed shifts gears…

Markets are pricing in the end of the rate hiking cycle and are beginning to position for cuts through 2025. We agree that 3-5 cuts in 2024 are likely and see a 50/50 chance at the March FOMC meeting this year.

For duration, we expect that tapering QT and a smaller Treasury Refunding will lead to a greater bid to the 10-Yr yield. Due to a slowing nominal GDP outlook, we see the Fed as moderating real rates with them settling closer to 1% through 2024. This drives our outlook for the 10yr yield to trade around 3.5%.

Credit impulse remains weak, but easier financial conditions should provide some reprieve…

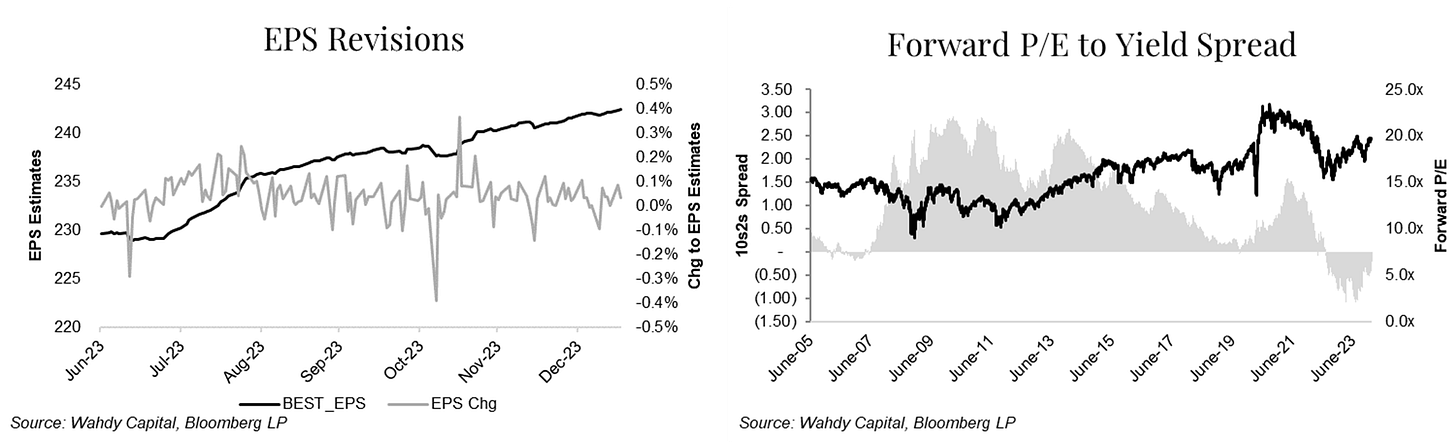

We see the S&P 500 trading around 5,000 this year though our 2H visibility is limited…

·Our top-down estimate of the S&P 500 in 2024 assumes a 13.2% EPS growth YoY and a P/E multiple of 20x. This is consistent with our view of positive-though-weak economic environment, 100-125bp cuts from the Fed, and a 10yr yield around 3.5%. The balance shifts to the downside if the long end of the curve drives a steepening, a scenario in which we think results in a compressed P/E multiple closer to ~18x. On the flipside, weaker economic data will put pressure on our EPS estimate. We don’t think there’s risk of lower economic data through Q1 of 2024.

Headwinds to GDP means we don’t see much greater upside to EPS estimates, we currently project ~$250 for the aggregate index.

High Level Coverage Views

Software

We expect spending to pick up in cloud spending, with budgets for public cloud rising 3-4% YoY, optimizations troughing, and consumption trends back on track.

While a weaker budget flush is in the cards for Cyber Security into Q4 2023, CIO survey data points to still-strong demand especially within end point and identity security. Pipeline should normalize into 2024.

UCaaS, ITSM, customer service, and license-based software to underperform vs. consumption-based software, as gen ai shifts the mix of workloads to chatbots and away from human agents.

An improving net new bookings environment, coupled with a broad-based margin story, should support software valuations, and may push revisions higher through 1H of the year given the large presence of recession assumptions in estimates. Current estimates point to about ~15-17% YoY sales growth across the sector.

However, an elongated sales cycle, weak SMB, and still-constrained corporate budgets (due to weak growth) should dampen any broad-based rally, though pockets of idiosyncratic performance and growth within certain verticals look very promising.

Hardware

We expect a rebound in the semiconductor industry in 2024, with volume and ASPs largely driven by the retooling of datacenters as they shift their workloads for gen ai processes (creating an up-cycle environment for network hardware, memory, and other semis), a modest pickup in traditional server spending due to stabilizing trends in cloud consumption, and an improving consumer electronics backdrop (smartphone and pc shipments).

EDA and Semi equipment will continue to benefit from Chinese demand along with the trend of custom chips as OEMs seek to optimize silicon to specific workflows.

On the downside, we continue to see headwinds in auto and industrial end-markets through 2024.

Supplemental Charts

Have comments, suggestions, ideas, or feedback? Send them my way!

Yours truly,

Muhammad Wahdy

Portfolio Manager

Wahdy Capital

Learn More | Schedule a Call | Investor Letters