Macro Note - Oct 2025

AI Circular Flow, our Q4 Outlook, and a tariff update…

AI Circular Flow, our Q4 Outlook, and a tariff update…

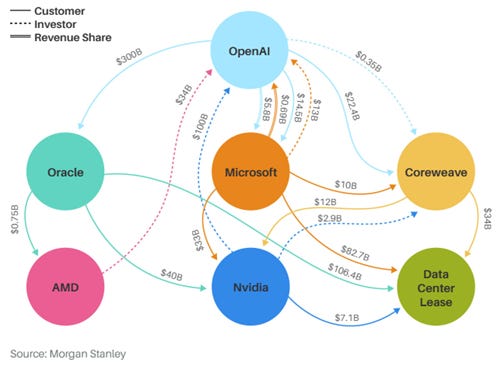

1. Strange deals are obscuring significant capacity constraints in the AI compute. Recent news of Nvidia’s $100 billion investment in OpenAI, OpenAI’s AMD deal (+ warrants!), and OpenAI’s huge $300 billion commitment to Oracle has raised eyebrows among investors and skeptics alike. Morgan Stanley recently published a chart outlining the web of intricate deals:

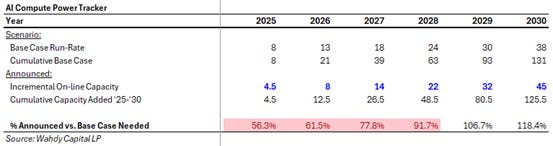

While much of the media, fintwit, and commentators have expressed skepticism over the entangled web of AI investments, we see a much simpler answer: compute shortfalls relative to targets. Our reference point is McKinsey’s April report on the cost of compute power, which suggests capital investment of $3 to $8 trillion needed by 2030. Since then, while the number of deals announced has increased, capacity build out is actually tracking at a lower run-rate than needed – pointing to AI compute constraints into 2028. Due to the significant amount of capital and resources needed, including the buildout and expansion of supply chains, we see the web of entanglements driving cash flow from high margin parts of the value chain (Nvidia) to low margin or capital-intensive parts (Oracle). In the interim, CEO hesitation (e.g. Satya Nadella’s caution in December 2024) resulted in an even larger constraint going into 2026. This is forcing hyperscalers like Microsoft to contract with neoclouds (e.g. Coreweave and Nebius) to bring in capacity in order to recognize revenue. These bottlenecks have become so intense recently, according to Bloomberg News, that Microsoft has had to turn away customers.

…but what about recursive revenue? E.g. Nvidia giving OpenAI to buy more Nvidia chips?

While vendor financing is not a new thing, the sheer magnitude and concentration of Nvidia – OpenAI and OpenAI - AMD deals imply some degree of risk. The way we think about it is that Nvidia is effectively subsidizing AMD in the near-term, similar to what Microsoft did with Apple in the late 90’s. In this case, it’s different because AMD is largely doing okay without Nvidia’s help. Ultimately, these deals are increasing potential supply in ’26-’30, which is needed to bridge the constrain gap. Why does this matter? Because OpenAI cannot generate sufficient revenue to fund commitments without access to adequate compute capacity… therein lies the biggest risk – not of an AI bubble bursting from the lack of customers, but of a painful reset driven by OpenAI’s revenue limited by compute capacity.

2. Our outlook for Q4 is for stronger than expected growth driven by upside to AI investment and better real-wages as the dollar rebounds modestly. Consensus estimates for Q4 2025 are 1.4% and is driven by worries of consumer spending decelerating into year end, lower private investment as housing continues to soften, modestly higher fiscal spending, and less trade. We are more optimistic – our forecast for growth in Q4 2025 is 1.7% Why? We see a strong wealth-effect driving consumption and support spending into 1H of 2026. On the investment side, we expect AI capex to step up substantially from Q3, with the limiting factor coming from lead-times on energy components. Real wages should also improve as the Fed’s cutting cycle, while real, is less dovish than the market was expecting earlier this year – and will lift the dollar into year-end. Fiscal spending and trade are the primary wildcards in our analysis, and could swing our estimates by +/- 0.3%.

3. New tariffs were announced. On Friday, President Trump announced new tariffs and export controls on China starting November 1 in the run-up to his meeting with Chinese President Xi at the APEC summit in Seoul at the end of the month. This was in response to China’s recent restrictions on rare-earth materials, which is largely seen as part of a maximalist strategy to Beijing to get the US to roll back much of the current tariffs and export restrictions – cumulative tariffs on China are estimated to be at around 57%, down from over 120% prior to the May 14 Accord. “China’s economy, which remains export-driven, has suffered from weaker global demand

Q4 Outlook Detail

Scenario Outlook

· We expect US Real GDP to grow between 1.7% to 2.1% between 2025 and 2028.

o In consumer spending, a smaller labor pool due to shrinking immigration will keep upward pressure on wage growth, even as jobs growth falls. If the job market breaks (unemployment rate > 4.7%), we would shift our thinking.

o In private investment, we expect a much higher rate of data center capex will boost corporate investment. In addition, an emerging wave of humanoid robotics and L4 autonomy in vehicles will drive the edge case for AI, potentially spurring another wave of capex in in ‘27+. Housing, while currently weak, should see support from lower interest rates. However, tariffs on softwood lumber and crackdowns on immigration may temper any improvement in affordability.

o Government spending is expected to rise based upon the OBBB Act, with significant increases to ICE and DHS budgets. We expect a rise in tech procurement from government as the administration aims to reduce headcount.

o Trade will rise modestly, with the trade deficit increasing as the import of components for data centers will drive the marginal shift in flows through a period where trade ex-AI will see a volume detraction due to tariffs.

· In the near-term, our Q4 forecast is for the US economy to grow at 1.7% Q4/Q4. We see a strong wealth effect driving consumption, upside to real wages from a modestly higher dollar, and higher-than-expected AI data center spending in private investment. Government spending and trade remain wildcards and can change our forecast by +/- 0.3%. The US Government is currently shut down over a budget fight between Democrats and Republicans, with no clear near-term path to resolution. We expect federal workers will miss at least two pay periods before a potential reopening (30+ days). On the trade front, recent new tariffs on industrial metals and autos will impact trade volumes modestly. We currently see steep auto tariffs and recent action on China as a negotiating tactic into the APEC summit by end of the month.

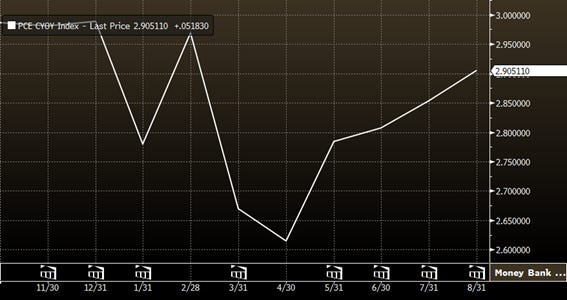

· In this scenario, goods imports will see rises, but we don’t see significant headwinds to inflation from tariffs after the initial step up. We are more concerned about services’ inflation, which could push the Fed into greater patience given its recent rise. Below is a chart of Core CPI YoY with indicators for when Fed meetings occurred.

· In monetary policy, we expect the Fed to cut between one and two times this year and up to two times next year, for a cumulative cut cycle of 100bp from September’s FOMC meeting. We expect the target rate to land at 3.25% with the Fed preferring to front load cuts. Recent action by the Trump administration to layoff workers will result in marginally weaker payrolls data that will keep the Fed defensive, barring a huge cyclical recovery (which we view as extremely unlikely).

· Ultimately, our view rolls up into a scenario of modest stagflation with upside risks to growth, driven by resilient consumption and stronger AI capex. While hot stagflation is still a risk, we think that would emerge in late 2026 after a big step up in ICE actions. We currently do not forecast a recession (odds less than 20%).

· From an asset class perspective, we favor equities and credit. Despite rallying over 10% this year, the S&P 500 can rise modestly into year-end, potentially crossing above 6,900. The core driver is better earnings prospects from megacaps which are predominately exposed to AI or an improving product cycle. We are cautious on the dollar, though expect it to trade slightly up into year end. While we liked Gold, we would trim holdings here and look to add to industrial metal exposure. In fixed income, we prefer US high yield but remain neutral on duration.

· What would change our mind: (1) sticky services inflation that delays cuts, (2) a term-premium shock driving long rates and USD up, and (3) capex digestion in AI supply chains driven by free cash flow concerns.

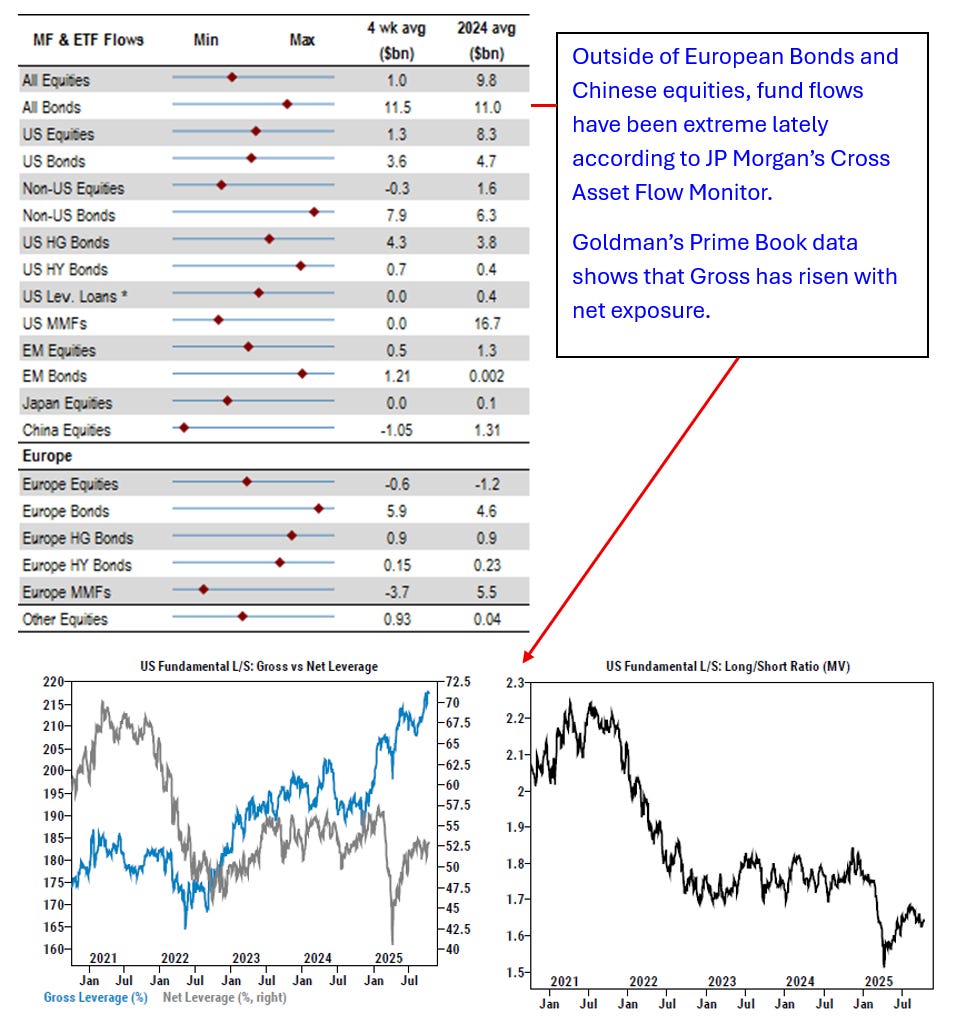

Positioning and Flows

· Gross leverage is elevated (95th to 98th percentile).

· Momentum factor has high exposure (>80th percentile).

· Mega-cap concentration is near extreme levels.

· Software ownership is light, semis are crowded.

· October put-call ratio was above 4 coming into the month, implying markets are hedged and suggests a “buy the dip” stance on major drawdowns.

Sector Views

Hardware – we remain long AI infrastructure as we expect continued strength in AI capex with deferred normalization in ’27 or beyond (see our forecast on page 2).

· Our base case for ’25-’26 is for easier financial conditions to support global capex and the AI infrastructure build out. We expect autos and smartphone to exit inventory recessions on new product launches and lower interest rates. While AI infrastructure remains a secular growth driver, we see risks emerging from power constraints.

· Risks to watch include a sell-off in the long end of the curve or delayed rate cuts tightening financial conditions. Export-control escalation (H20, CoWoS, etc.) and capex digestion also remain a concern.

SOX / IGV Spread looks a bit stretched:

Software – the setup for software remains attractive as sentiment is weak despite better incremental data points. We expect usage reacceleration into 2026 as employment remains soft but productivity rises, allowing IT budgets to rise.

· Our base case for ’25-’26 is for rate cuts and easier financial conditions to boost software multiples. We expect IT budgets to expand modestly due to greater productivity. Cloud and AI spending will remain elevated as the cost of compute falls and investment in AI workflows increases.

· Risks include a patient Fed, major slowdown in AI adoption, and margin compression from AI infrastructure costs.

AI Winners / IGV Spread also looks stretched:

Disclosure

The information contained herein reflects the views and opinions of Wahdy Capital LP (“Wahdy Capital”) as of the date of publication and is provided for informational and educational purposes only. It does not constitute investment advice or a recommendation to buy or sell any security or to adopt any investment strategy. The views expressed are subject to change without notice and may differ from those of other professionals or market participants.

Although the information contained herein has been obtained from sources believed to be reliable, Wahdy Capital makes no representation or warranty, express or implied, as to its accuracy or completeness. Past performance is not indicative of future results. All investments involve risk, including the potential loss of principal. Any securities or strategies referenced may not be suitable for all investors.

This material may not be reproduced, redistributed, or transmitted, in whole or in part, without the prior written consent of Wahdy Capital LP.