FOMC Review

New regime, new rules

Yesterday’s FOMC decision — unchanged at 5.25-5.50%, with an emphasis on patience — came in as expected. What was unexpected was Powell’s regime shift:

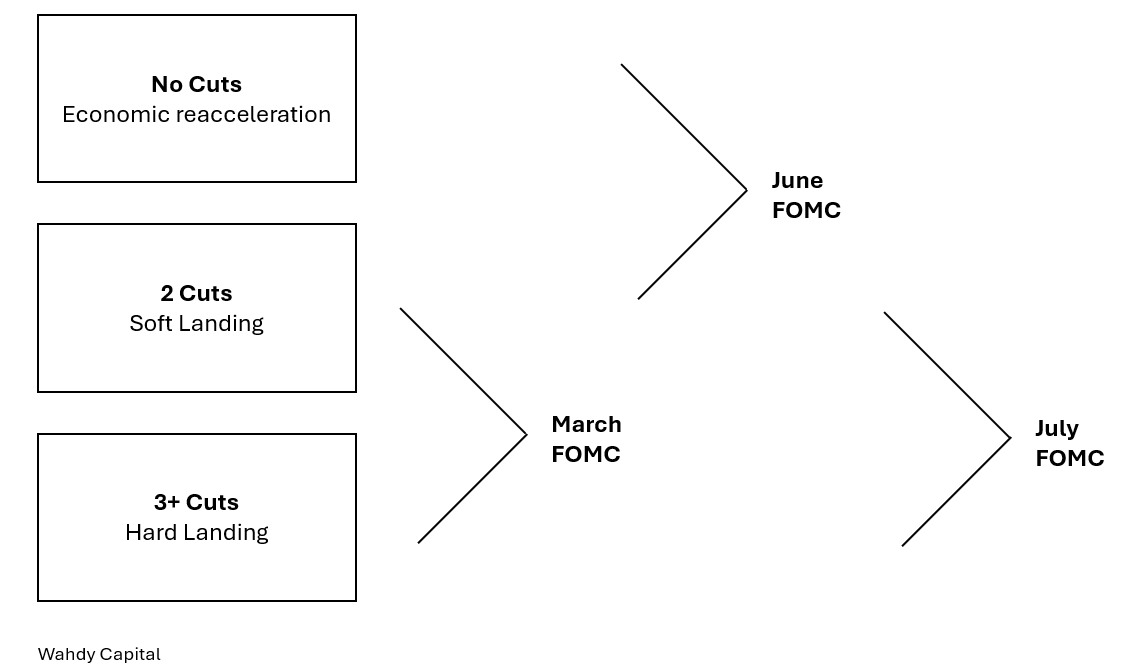

In the June FOMC meeting and SEP (Summary of Economic Projections), the Fed moved from a “2 cuts or 3 cuts +” regime to a “2 cuts or no cuts” by 2024 regime.

We saw that as a mistake and weren’t convinced that hard data was bad enough for the Fed to shift the regime back to a “2 cuts to 3+ cuts” regime in July.

We expected Powell to double down on the June SEP projections. Instead, Powell stated that as long as the data moved in-line, a September cut was “on the table” which was a firm rejection of a “no cut” scenario. Don’t be alarmed if you’re confused — this sort of policy and macroeconomic volatility is confusing everyone.

Here’s a rough approximation of how the Fed’s implied regime’s have switched:

Key takeaways from the press conference:

Powell stated that being data dependent is not the same as being data point dependent — in other words, one bad print wasn’t going to cause panic

The FOMC feels confident that it can response if labor markets weaken materially; but in their baseline scenario, weakness in the labor market is expected

Importantly, Powell noted that the Fed does not have a growth mandate — a brief contraction does not necessarily run against the Fed’s targets

Powell said anecdotal surveys of the economy are not uniformly bad — he mentioned discussions with Regional Presidents about the economic performance in their district and how the picture was mixed but still positive

My takeaway is that Powell, and the FOMC, see the economy on the path towards a 2-cut scenario (soft landing) where they can quickly pivot to 3+ cuts if necessary.

Cross Asset Implications

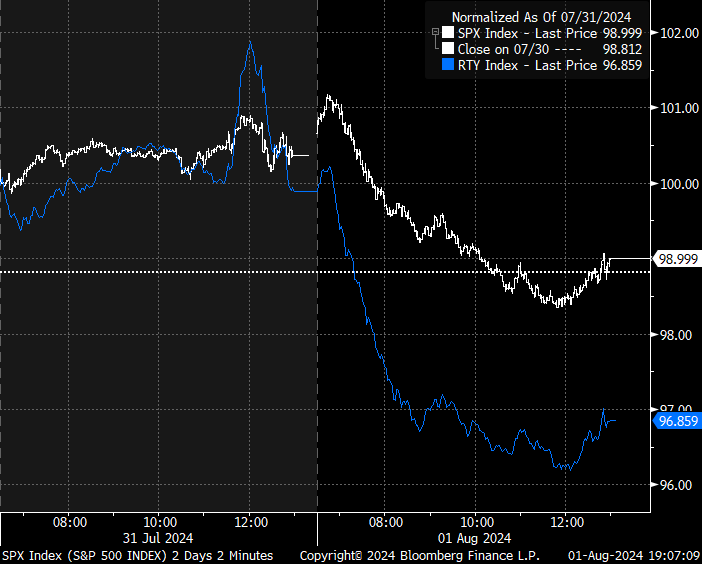

The immediate reaction to Powell’s comments were a rally in equities. Our thesis of a factor rotation driven by a weaker economic outlook seems to be in play.

The Russell 2000 (small caps) underperformed vs. the S&P 500:

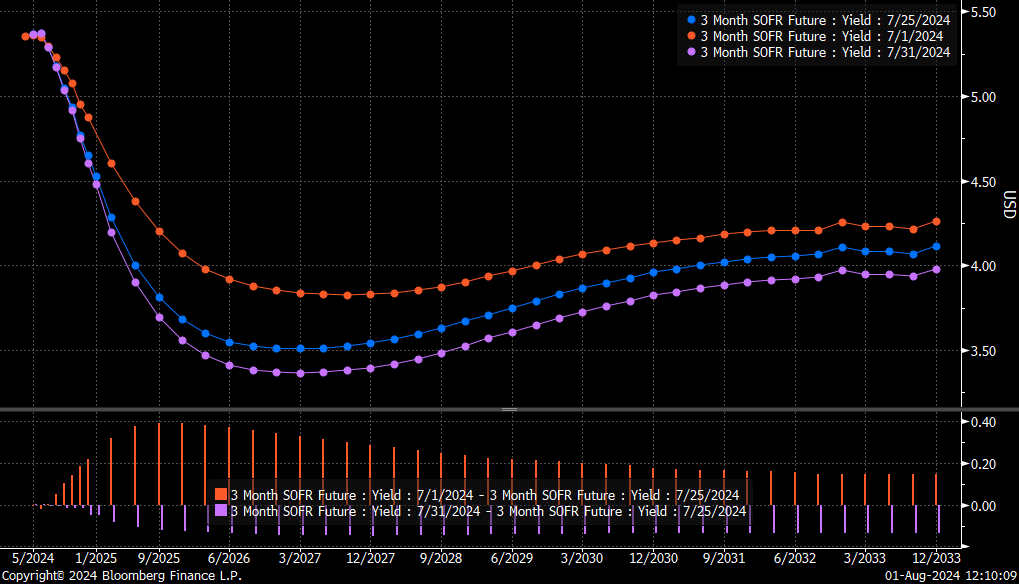

SOFR curves moved lower— pricing lower interest rates and lower growth into 2026:

Our View

At the high level, our view is that the economy is on a slower trajectory into 2025. This should support mega caps and AI hardware winners, with smallcaps and cyclical sectors underperforming. We have advocated for a defensive posture and laid out our concerns for a choppy Q3. However, we are not forecasting a recession or a major market crash.

Today’s market reaction, in the near-term, seems to be an overreaction to Initial Jobless Claims, weak ISM Mfg Employment Index data, and incremental information from earnings (Intel’s job reduction announcement).