FOMC Recap Note

A hawkish 50bps

The Federal Reserve announced a 50bp cut this Wednesday, citing the progress made towards inflation, a cooling jobs market, and a solid economic expansion. In their press release, the FOMC increased their confidence in their inflation target, and sees risk balanced between its dual mandate of employment and inflation. Noting an uncertain economic outlook, the Fed also stated they are prepared to adjust the stance of monetary policy if risks emerge.

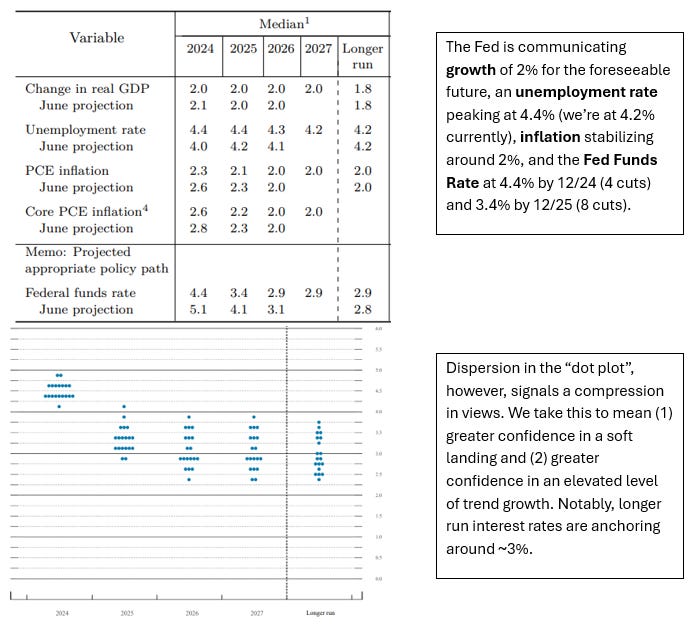

Highlights from the Summary of Economic Projections (“SEP”)

Portfolio Manager Views

Muhammad: “This was a hawkish 50bp cut. If you look at the rates market, SOFR and Fed Funds Futures were pricing in closer to 3% (10 cuts) vs. the Feds 3.4% (8 cuts) by 12/2025. Since the FOMC, yields have risen, corroborating my view that the Fed has marginally tightened financial conditions. The Fed seems to be betting on a soft landing scenario, and very recent data flow is neutral or leans slightly positive. However, I remain cautious on equities in the near-term as we enter a seasonally difficult time due to the blackout window limiting buybacks, quarterly rebalancing, and my view on incremental economic data. I’m not calling a recession, just a weaker growth environment as the tailwinds from the post-Covid boom fade.”

Darren: “I’m a bit more bullish on the economy. I expect a soft landing, not a recession. Powell did a great job of threading the needle and recalibrating policy, and the market is accepting that. We’re in a pretty good spot, and can move forward as macro uncertainty diminishes. Importantly, we should begin to see more of the factor rotation as the equity market broadens. The marginal dollar will flow towards cyclicals and may pose a headwind to parts of our coverage, but as equity correlations drop, bottom up stock picking should perform.”

Cross Asset Views

Rates: With the Fed communicating a slightly higher rate by 12/25, bonds should sell off marginally with the 10-year anchoring between 3.6-3.8%. Bonds are reflecting a very weak growth outlook for 2025, so if data begins to skew neutral or positive, there is room for further bear steepening.

Dollar: A higher-than-expected rate outlook means the dollar will rise relative to other major developed market funding currencies, such as the Euro and Yen.

Commodities: The start of an easing cycle will boost demand for commodities as the industrial sector tends to rise as interest rates fall.

Equities: A soft-landing scenario will support higher earnings expectations and drive a sector and factor rotation. On the margin, expect headwinds to Mag7 stocks and other high growth sectors, as small cap and cyclicals are bought.

Exposures and Factor Tilts

With a soft landing likely and factor rotation underway, we expect our small-cap exposure to rise, while trimming our large cap and crowded names. We’ll stay agile, ready to adapt to market shifts, and will closely monitor risks like inflation and geopolitics.

Thank you for your continued support and trust in us.

Best regards,

Muhammad Wahdy

Portfolio Manager

Wahdy Capital

Learn More | Schedule a Call | Investor Letters